Market Update for Friday, February 15, 2019

Market Update for February 15, 2019 |

_______________________________

Market Update for Thursday, February 14, 2019

This is the CHART SHOW

The Chart Show for February 13, 2019 |

_______________________________

Market Update for Wednesday, February 13, 2019

CHART SHOW signup

Market Update for February 13, 2019 |

_______________________________

Market Update for Tuesday, February 12, 2019

CHART SHOW signup

Market Update for February 12, 2019 |

_______________________________

Watching … Waiting

Watching … Waiting

We’re very, very close to a top of this corrective wave up from the December 26th bottom. As a result, it’s critical that we’re very cautious about playing what I believe is the small final wave up.

As I often say in these situations, “the surprises will be to the downside.”

At first glance the waves down in the SP500 appear to be in five waves. I’ve spent hours going over the 1 to 5 minute charts on all the indices and I’ve come to the conclusion that we have three waves down at the moment. There’s no question this is the case in the Russell 2000, a chart of which you’ll find just below.

However, there is a wave configuration that’s an extended first wave down that starts off with the first part of the first wave as an apparent three-count. That being the case, we need to be extra careful with the current setup. There’s no question that a top is in the works.

On Friday, we completed what looks to me to be a first wave up in five waves. That forecasts a B wave down and a C wave up. While I believe we’re going to a new high, based upon my analysis of the wave structure, there’s certainly the possibility that things could change over the next twenty-four to forty-eight hours.

I’ve already shared my thoughts on timing. It seems to me slightly early for a top, by at least a few days, and maybe a week. A top on February 5 is a wave up of six weeks when the wave down from the all-time high took 12 weeks. Since the wave up has retraced 62% of the wave down, I would expect a wave up of about 7 weeks, and perhaps a couple of days longer than that. That would put the top at February 13 at the earliest.

So, here’s what we need to look for in ES:

- Fifth wave to a new high: If we’re going to a new high (which I expect), then we need to see a second wave down from the close on Friday to about 2692. Then we need a third wave up that keeps going very close to a new high (my measurements target 2737 in ES for the third wave. That should lead to a deep fourth wave and a fifth wave up to a slight new high.

- Second wave up 62% and a reversal: if somehow my count is wrong, then we’ll be looking for a B wave down (which may not reach the 62% retrace level of 2692), that will lead to a C wave up that will only reaches slightly above the 2716 level in ES before reversing and dropping to a new low.

My work this weekend tells me the former is more probable, but I want you to be alert to the option.

In this weekend’s video, I take you through a 15 minute chart of ES, where I explain what I’m seeing.

_______________________________

IWM – Russell 2000

Above is the 15 minute chart of IWM (the Russell 2000).

While the most recent wave down in some US indices is questionable as to whether it’s a five-waver or a three waver, this index is unequivocally a “three.” Since all NYSE indices move up and down together, you can’t have one with a corrective wave moving up, while all the other ones move down.

You always look for confirmation across indices whenever you get questionable waves.

Therefore, I’m expecting one more wave up to a new high to complete the 5th wave of the 5th wave of the C wave in the US indices.

Elliott wave is based on probabilities, of course, and this appears to be the most probably outcome, based upon the current wave structure (and what other asset classes are doing).

Lots of Uncertainty in Currencies

USD currencies are not providing many clues at to what the next move will be. I’m unable to come up with a count that I can rely on:

USDJPY continues sideways.

EURUSD is down in three waves so far and doesn’t measure properly, so it’s either going to retrace of move down to finish the current wave.

GBPUSD has come down in three waves and needs to correct this wave with a new high, imho.

AUDUSD has the strangest set of wave down that don’t have any kind of fibonacci relationship that I can find. They appear corrective to my eyes.

USDCAD has reversed as predicted, the wave up on Friday is corrective, so it has more of the current correction to complete, but I’m unsure if this is a second wave or a fourth wave to the downside.

____________________________

Elliott Wave Basics

Here is a page dedicated to a relatively basic description of the Elliott Wave Principle. You’ll also find a link to the book by Bob Prechter and A. J. Frost.

_______________________

Trend Changes: How to Enter with Reduced Risk

First/Second Wave Combination: This is what to look for if you’re entering a trade after a trend change.

___________________________

Week at a Glance:

Use the usual amount of caution and if you’re using EW for entries, it requires entry on a second wave (a 62% retrace of the first wave). Wait for the turn. These summaries are not “official set-ups,” but rather a summary of the movement expected this week.

- ES/SPX/NQ – Setting up for an imminent turn down

- WTI Oil – Retracing a corrective wave down – direction still up

- Gold/Silver – Setting up for a turn down

Current Timing in the SP500:

- Red A wave down from the all-time high: 12 weeks (Oct. 3 – Dec. 26)

- Red B wave up 62% from ~2330 low: 7 weeks at Feb 6 (Dec. 26 – Jan 13 — 7 weeks?)

- Red C wave down to possibly 1800: 14 weeks takes us to May 22

_______________________________

Here’s the latest daily chart of ES (emini futures)

Above is the daily chart of ES (click to enlarge, as with any of my charts).

We have a B wave that’s now risen 62% of the of the height of the previous set of waves down from the all-time high.

This past week, we had a wave down in the US indices that, at first glance looks like a “five.” However, to my eyes, the additional waves within it suggest that it’s corrective. it also dropped slightly below the 38% retrace level of the previous set of waves up. First waves need to drop to the previous fourth wave of one lesser degree, which it did not do.

In IWM (the ETF for the Russell 2000), the waves down are undeniably in three waves. Since all NYSE sub-indices must have the same count and can’t move in opposite directions, the probability is high, imho, that we’ll see one last new high in ES.

There is also the question of timing. The waves down from the all-time high to the Dec. 26 low took 12 weeks exactly. The B wave up from that low, that we’re at the top of now, has a high at February 5. That’s one day shy of six weeks.

However, the B wave up has risen slightly more than 62%, so I would expect in this case, that it should take a relative amount of time to complete, closer to seven weeks, or slightly longer (by a day or two). That suggests the top will be this week.

On Thursday night, I called for a bottom in the current area and a turn up in a first wave, which we now have. The wave up looks motive and rose to slightly above 2705, which was my call. This is consistent with the start of 5 waves to a new high.

Let’s see what happens this weekend, but the probability, as far as I can see, if for a new high to complete this B wave.

There are other asset classes (currencies, oil, silver, and gold) that also suggest a new high is coming in the US indices.

Summary: My preference is for a dramatic drop in a C wave to a new low that should begin this week. The culmination of this drop should mark the bottom of large fourth wave in progress since January 29, 2018 – over a full year of Hell. It may be a dramatic drop that lasts multiple months, and will target the previous fourth wave area somewhere under 2100.

Once we’ve completed the fourth wave down, we’ll have a long climb to a final new high in a fifth wave.

_______________________

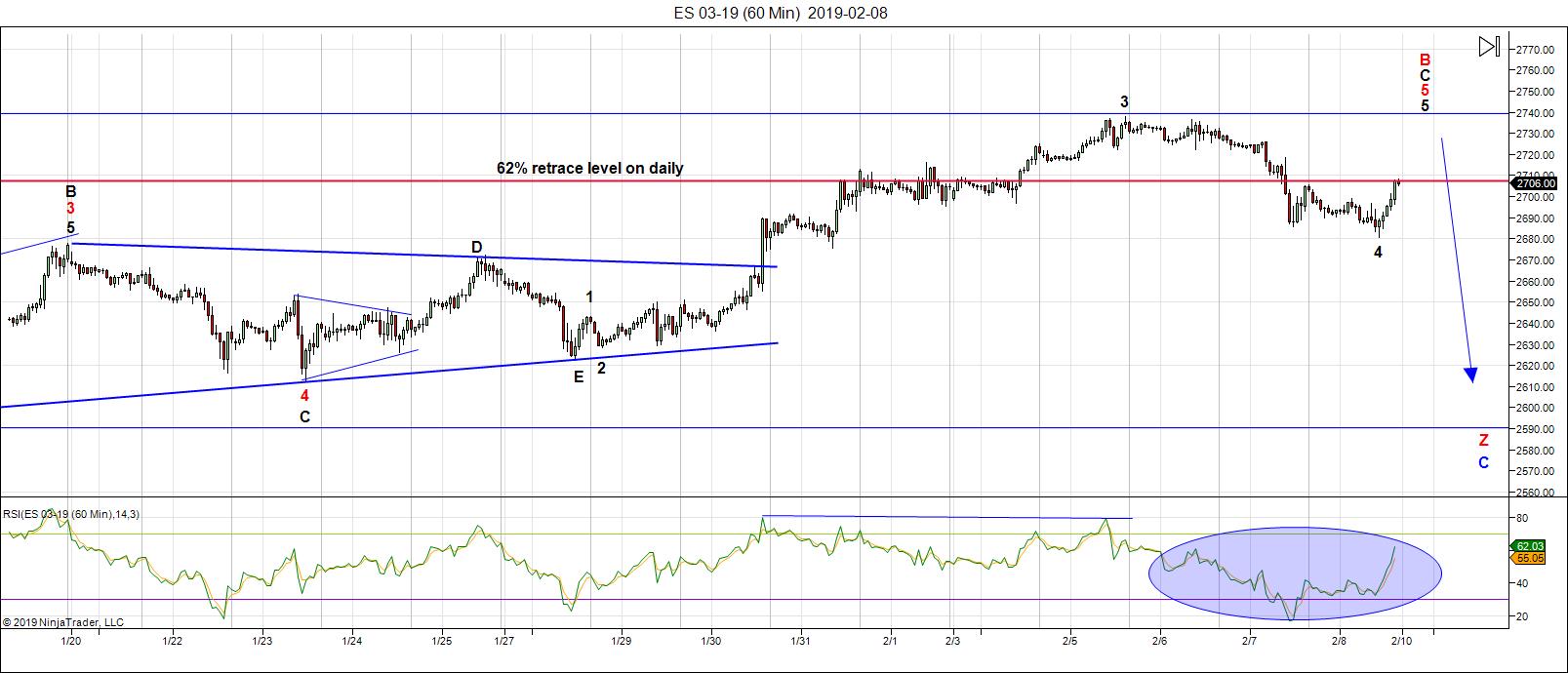

Here’s the latest 60 MIN chart of ES (emini futures):

Above is the 60 minute chart of ES (click to enlarge, as with all my charts).

With the achievement of the 62% level of this large B wave, I started to think about the time factor involved in relationship to the waves down from the all-time high. It gave me a concrete fibonacci level that I could equate with the larger timeframe.

Corrective waves on this scale (particularly second waves in a bear market) retrace in relative timeframes to the waves of the larger trend.

So, for example, a B wave that retraces 62% of a preceding larger wave down of 12 weeks, should retrace to that golden mean level in approximately 7 weeks (or even a couple of days longer). That would suggest a turn mid-to-late week (Wed-Fri). That’s my working prognosis for the timing of the turn going into this week.

The waves down so far last week appear to me to be corrective, although the wave structure at first glance appears to be in five waves. I see telltale signs that it is not.

The wave down also did not retrace to an appropriate level for a complete first wave. Now, keep in mind that it’s possible that it could be the start of an extended first wave; however, the rally up on Friday rose above the 38% level of a higher degree fourth wave (you can view the structure of a typical first wave by clicking here.

I go through the structure of the current 4th/5th wave combination in this weekend’s video.

Then there’s the problem of the Russell 2000, which has come down in three waves. Oil has also come down in a corrective wave and requires a retrace to the top again. Currency pairs looks like they’re going into a countertrend move, but I’m unsure as to how far that move will go. Gold and silver also look like they’ve dropped in a corrective wave and have not topped.

In any event, we’re looking for a top in place this week. It’s prudent that we take great care if trying to trade the final wave, just in case I’m wrong in my count.

My extreme targets suggest we’re going to get a drop of 900 points. I can’t guarantee that level, but I can’t come up with a good reason why we won’t get there. So many factors seem to be pointing to that level. The wave structure on the way down will give a good indication of what to expect, though. As well, we have lots of other asset classes that will help with warning that a bottom is coming.

Virtually eveything is going to turn at the same time and I expect them to reach their targets for this move at about the same time.

The key levels for the bottom of the first wave down (there are previous fourth waves) are 2598 and 2562. Then look for a three wave retrace up to around a 62% level (remember, this is likely to be a zigzag down, so the second wave doesn’t have to make it right to the 62% level — be on the lookout for a slightly lower turn).

Summary: I’m expecting a zigzag down to finish off this never-ending (year-long) larger fourth wave. Look for the turn down this week. It will will lead to a dramatic drop well below the previous low.

USD currency pairs, oil, and possibly gold and silver should turn at the same time as ES/NQ/SP500.

This next bottom will confirm the end of the year-long Fourth Wave from Hell and start of the final fifth wave up to an all time new high.

_____________________________

Housekeeping:Site navigation: You can find all the specifics on site navigation and elements you might not be aware of by clicking here. Next Federal Reserve Annct: Meeting is Wednesday March 20, with a statement at noon EST. New Free Blog Post: The Pressure is Mounting The CHART SHOW signup is live for Wednesday. You can sign up now in the usual spot by clicking here: webinars. Problem receiving blog comment emails? Try whitelisting the address. More info. Moons, Eclipses, PlanetsFeb 19 — Full Moon Mar 20 — Full Moon April 19 — Full Moon July 2 — Total Solar Eclipse July 16 — Partial Lunar Eclipse Dec 26 — Annular Solar Eclipse |

Market Report for Monday, February 11, 2019

CHART SHOW signup

Market Report for February 11, 2019 |

_______________________________

Longer Term Charts

Above is the hourly of the SP500. (click any of my charts to enlarge)

The projection here is the same as for ES. After a six week “bear market rally,” we’re at a top — more specifically, the 62% retrace level of the entire wave down.

This chart shows the full 5 waves up of the C wave, which makes it much easier to see the corrective nature of this wave from an Elliott Wave perspective.

Measuring from the first A wave, we’re now at a level where the C wave up is exactly 2.618 times the length of the A wave, which is usually the maximum retrace level for a corrective wave.

Look for a turn down this week; the target on the downside will be similar to that of ES. I expect this to be a multi-month decline and to strike some real fear into the hearts of minds of anyone paying attention to the economy.

Above is the two hour chart of the US Dollar Index.

It’s important to pay attention to the dollar because it’s the thing that’s moving the entire market (all asset classes that I cover, at any rate).

It’s not clear what the next move for the dollar is on a short-term basis. I expect to see a corrective move to the downside, but I don’t know if it will be a fourth wave (38%) or a second wave (62%). All currency pairs are exhibiting a potential for a retrace.

The issue is that the current wave up does not measure as a complete wave — we seem to be in the middle of a wave up. In any case, the larger direction is up, so any three wave move to the downside would be considered a potential entry for a continuing rally.

This week, I raised the concern that the pattern we’re in does not look like a usual ending diagonal, but I don’t have an alternative pattern to suggest here. The concern is that with the US indices set up for a large drop, it seems unlikely that the US dollar will rise to only the 99 level, which would be the maximum level for the fifth wave of an ending diagonal.

In the meantime, the intermediate direction is to the upside with a minimum target of 99.

The longer term scenario that I’m expecting is a complete retrace of the dollar right back down to the 89.50 area. I expect this wave will trace out as the US indices finish up the fifth wave to a new high and end the 500 year rally.

Above is the daily chart of EURUSD. Caution at the moment in this and all currency pairs.

Last weekend, I predicted a turn to the downside, which we got. The larger direction is to the downside.

In the short term, I’m looking for a retrace up, but I’m unsure as to the level to expect. There’s no set up here. I would urge caution. Best to wait until we have a clear pattern.

Any retrace in three waves would be a set up for a trade to the downside. Weakness should continue in the longer term. If this is an ending diagonal in play, expect a continuing drop to the 1.09788 area, which would be a maximum low. If we have some other pattern in play, EURUSD would likely drop even further.

Once we reach a bottom, which may be weeks away, we’re going to have a change in trend, which should lead to a new high above 1.25631.

More in the weekend video.

Above is the 3 day chart of GBPUSD. Caution at the moment in this and all currency pairs.

Above is the 3 day chart of GBPUSD. Caution at the moment in this and all currency pairs.

I’ve been suggesting this pair may rise higher to a double top in 1.33 area, for a B wave. The current wave we’re in to the downside is in three waves, so I’m still expecting a complete retrace to the 1.323 area. If we reach that level, look for a turn down (with the other USD currency pairs) and a target of a double bottom in the 1.10655 area, or a lower low.

After we find a bottom, expect a trend change. The bigger picture is that we have an ABC set of waves down that must fully retrace up to the 1.33 area, at least.

More information on the short term prognosis in the video.

Above is the 3 day chart of the AUDUSD. Caution at the moment in this and all currency pairs.

The large pattern down in this currency pair is very confusing. I cannot get any fibonacci measurements to work; the waves themselves look corrective. I’m expecting a retrace to the upside, but it’s unclear now high this rally will go. Longer term, I’m expecting a large set of waves down to a new low. However, we need AUDUSD to provide more information as to where it’s going, both short and intermediate term. Lots of caution needed here.

After a low is in place, we’re looking for a major change in trend. The target on the upside will be the 38% retrace, which is where the previous fourth wave has topped, at 0.8155.

More in the video.

Above is the 3 day chart of USDCAD. It moves opposite in direction to AUDUSD (due to the orientation of the charts).

The last couple of days, I’ve been expecting a turn down and a partial retrace of this large rally. More downside is expected short term, but I’m unsure as to what the downside target is.

The longer term direction is up and after the US indices turn down in earnest, we should see a large rally here that will target the 1.38 area at least.

Once USDCAD has rallied to its final high, expect a drop to the long-term target of 1.18. That large wave down should coincide with the final 5th wave up in the US Indices (that will finish off the 500 year rally).

Once this pair hits the final downside target of ~1.18, it will turn up and will eventually rally to a new all time high for USDCAD well above above 1.46254.

Above is the 3 day chart of USDJPY. For this pair, the longer-term prognosis is for a big drop to the 94.6 area after a top at about 118.5.

I’m expecting a full retrace up to the 118.5 area before a turn in the opposite direction and a drop to a final target of 95, or so. In the meantime, this pair has been moving sideways, not providing any indication of shorter-term direction.

I’m projecting a partial retrace of the US dollar and this should lead to some short-term weakness in this pair, but so far, we haven’t seen any. As with the other currency pairs, we need to get some clarity as to where we are in the wave structure.

Finding an entry for this pair has been difficult and I still don’t see anything I’d recommend; however, I’m extremely confident in the outcome. In fact, with the revised long term forecast for the SP500, I would expect we’re much more likely to reach a target of 118.5 before turning back down.

CAUTION: Since this is a very volatile pair at the moment, I’d recommend letting it find its way back to the top before attempting the less riskly move from a new high to the downside, which should be a protracted move to the $94 area. I expect this downside move in tandem with the final 5th wave up in the US indices. We’re not quite there yet, of course.

After we hit the long-term downside target (~94.6), I expect a turn up in an impulsive third wave far, far above 130.00.

Above is the 2 day chart of gold.

Gold has rallied as expected in a small fifth wave and sit slightly above the measured target of 1325. I’m still skeptical that the triangle shown on the screen is a real one, so we’re now in the area for a turn down. It’s likely gold and silver are going to turn down with the US dollar turning up (and US indices turning down).

Short term the small waves to the downside are corrective, so it doesn’t look like we’ve topped yet. However, the top is very close. More info in this weekend’s video.

Longer term. I’m looking for a target on the downside of 1043 (the previous low).

After a bottom at around 1043, look for a wave up in gold to the 1600 area.

Above is the 3 day chart of WTI oil.

Oil has topped long-term. We now have (or almost have) a first wave down in place. We’re looking for a bottom, which is definitely not in place yet.

On a short-term basis, oil appears to have trace out an ending expanding diagonal at the top of a corrective wave up that that appears to be finishing a fourth wave flat.

The most recent turn down on an hourly chart exhibits overlapping waves, so the direction is still to the upside: Expect a retrace up to the upper trendline of the ending expanding diagonal in progress.

Longer term, I’m expecting a turn down to a new low below 42.50 and perhaps a lot lower.

More info on the short term projections in the video.

Above is the weekly chart of the DAX. (click chart to expand)

DAX bounced off the downside target of about 10,319 and did so in a corrective three waves. I’ve been calling for a turn down, which we now have.

I’m expecting further weakness, with a projected target at the previous fourth wave level, which is at about 8700, which is also the point at which the C wave would be 2.618 X the A wave down.

You’ll also find a projection for the DAX and another write-up on this weekend’s free blog post: https://worldcyclesinstitute.com/the-pressure-is-mounting/

Longer term, once we have a confirmed bottom in place, expect a rally to a new high in 5 impulsive waves.

Good trading!

Other than futures, there was little movement over night.

ES and NQ are all over the place in this ending diagonal. Both have corrective waves up this morning, so they should turn and head down to their targets after the open. I would expect to bottom today and turn back up in a 5th wave before the open.

Good call Peter! Sold ES short yesterday and caught the big 4th wave down. Thanks sir. Now lookie lookie it bottomed and long @ 2735. Think we hit the 2,785 to 2790 today? Or still into mid week next week?

See my comment from this morning. If we go a a new high (above the upper trendline), I’m wrong. But this is a very small fourth wave so far.

sold at 2770 for 35 point gain. Thought we were going into 5th wave?!??? But with you unsure, I’ll take my profits & run 🙂

Good for you. Too uncertain at the moment. I don’t think a top is in by the looks of the waves, so this might be a larger fourth, but we’ll need to wait and see.

The US indices is the strangest market. I’m not sure now what’s going on.

ES looks more like a wedge than an ED, simply because the fourth wave is so small. Technically, with a touch of the upper trendline, as we have this morning, the ending diagonal is complete and we could have a top. But is that the case?

The wave up should be more complex than it currently is to be the final wave (they don’t have to do a throw-over, but I would think we’d see one in this case).

My first thought is that this is a fake-out, and we still have to trace out a fourth wave, but I could certainly be wrong on that. We’re going to have to see what the market has in store.

If we start to come down in 5 waves, that would suggest a top is in, if in three waves, a fourth wave of the ending diagonal.

The wave down appears to be corrective in ES and NQ. We’ll have to see where it goes, or if it goes anywhere at all.

We’re looking for either a first wave down (but I don’t think this is it) or perhaps a larger fourth wave of the ED. The wave up could have been an extension of the third wave of the ending diagonal. There are several options at the moment.

Oil is flirting with a double top, but hasn’t quite made it yet. Gold has moved up a bit, but has a ways to go to reach the previous high. No clue from currencies, which have hardly moved in the past couple of days.

. . . hate sounding like a broken record, but nice call for crude to head back up to their previous highs! I’m getting short with about half my position and waiting for the possibility of 57.xx if they extend toward your upper trend line. Thanks for all your work professor Temple 🙂

Well, it sure ‘feels’ like we’re putting in a top, but I’m going to stay conservative and wait until I see a first and second wave of some kind. The current wave structure in both oil and index futures, other than being in a final pattern, sure aren’t providing much information. Great place out OTM short options, though … but I’d still like to see more clues from the market.

It’s been a frustrating 7 weeks waiting for this thing to find a top.

Gold is moving up rather quickly now to a possible double top.

EURUSD completed an ending diagonal and now appears to be heading up in a second wave with a probable top of 1.14, as mentioned in the last couple of days in my reports.

EURUSD may still be in that ending diagonal … really hard to be sure. If so, we only have a fifth wave down to a new low to complete and then we’d complete a larger second wave. Other pairs are near inflection points. Again, I wouldn’t suggest picking tops or being in anything until we get confirmation of a top.

I’m seeing virtually everything near tops, so there’s a possibility for near the last hour, or we’ll likely go sideways over the weekend and top Tues/Wed. The issue is everything topping at the same time. We’re likely to sit until it’s all lined up.

We’re obviously going to grind away through the weekend, which was my original expectation. I’m surprised the ending diagonals in ES, NQ, and SP500 have completed so quickly. When I say completed, the final wave up seems to be just an A wave, needing a C wave up still.

Gold is at 1322, which just 4 points away from the previous high. Oil is at its previous high. Some currency pairs are at targets (AUDUSD, for example) and others are close. Currencies are in slightly different wave patterns.

So, there’s a little bit of work to do in different asset classes, but they’re all lining up slowly … ‘slowly’ is the operative word.

I’ll spend some time on ending diagonals this weekend. They have relatively dramatic turns and always revert back to the previous fourth wave of one lesser degree. For ES, that’s the 2600 that I’ve been citing for a while now.

It’s difficult, but a little more patience. I want to see a top before calling anything. We’re very close. This has been a really long haul, but the wave down will be worth the wait.

https://www.zerohedge.com/news/2019-02-15/bears-are-right

Trumps state of emergency had zero impact so far…

I didn’t expect it to. There’s huge resistance in this area. I’ve been trying to see if I can make this structure up NOT an ending diagonal (ES/NQ/SP500)_, but can’t seem to do it. However, I’ll spend more time tonight (it’s a Devil’s Advocate thing I do to try to disprove my count).

If it is, we’re going to get a dramatic turn … but the waiting is enough to make you crazy.

If an ending diagonal, the upside is higher now, because the 4th wave was so short. 2810 is the max. NQ is lagging quite a bit.

Peter many of the EWers are saying this is the 5th wave and ES should hit new highs. Basically the bear market of 2018 being the bottom of the 4th (low on dec 26) and new all time highs soon. Is that even possible?

Good for them and no, it’s not possible. Wait til you see the greed readings on the weekend.

I like it when the pretenders are on the other side of the market. EW International has the same count as me, which is scary, but then they think the market has topped overall, which is also impossible (according to Mr. Elliott). They have an exceptionally good record of being wrong.

I’m used to not running with the herd, as Verne pointed out today in the free blog.

Last weekend, everybody was saying we’d topped and were heading down. I was getting people emailing me Andy P’s Feb 5 topping declaration, and other cycles turn dates. But I said we were going up. Guess what? We went up.

Yeah I don’t see how they see 4 and then 5 up with such corrective looking waves. How do some analysts (and these are ones who claim to know EW inside and out) get it so wrong? Glad you keep it real. I really respect your work and helping to keep us out of trouble!

Hopefully within next few weeks we see a top. Will look to go short again once there’s a clear wave down.

The new weekend blog post is live at: https://worldcyclesinstitute.com/even-more-bearish/

The video is still uploading (should be done by 4:20 EST at the latest)