Nature's Cycles Affect Every Living Thing |

Nature’s cycles affect every living thing on Earth.

Edward R. Dewey, who worked for US President Hoover in the 1930s was a pioneer in the discovery of natures cycles. They affect business, the markets, and so much more. You’ll find links to Dewey’s books on my recommended books page. They’re all imminently readable and fascinating in the scope of the work on major cycles.

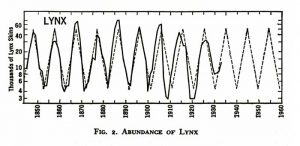

Here is the Canadian Lynx cycle from one of his books. The “abundance cycle” is still in effect today—9.6 years. I note that there was even a recent study in Canada to try to find out the cause, but of course, the researchers knew nothing about cycles and so were running blind.

Here is the Canadian Lynx cycle from one of his books. The “abundance cycle” is still in effect today—9.6 years. I note that there was even a recent study in Canada to try to find out the cause, but of course, the researchers knew nothing about cycles and so were running blind.

I’ll just add a note on the Lemming. Every 3.86 years, it isn’t compelled to race to the sea and kill itself (as in a Disney film, which was apparently staged). Rather, it seems to be an overpopulation problem.

The lemming simply expands in numbers until it devours all the available food and then migrates to other areas to find more. They eventually reach the sea and drown in large numbers trying to find a route to more food.

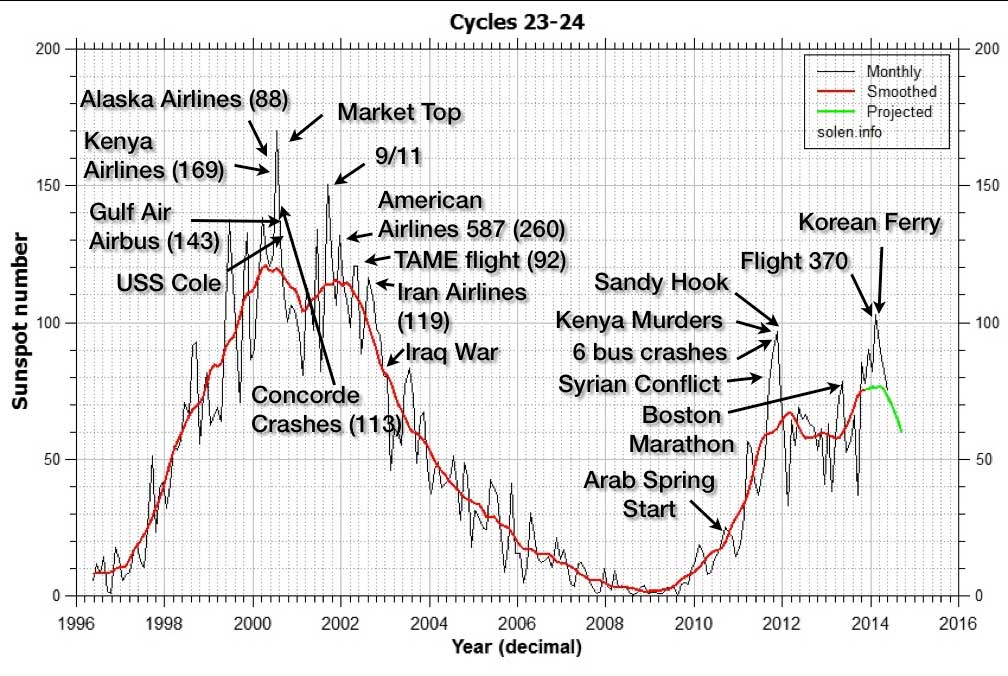

Sunspot activity also moves in cycles—11.2 years. Alexander Chizhevsky, a Russian scientist, studied the statistics and histories of seventy-two countries and found a Human Excitability Factor that coincides with the solar peaks. Wars, revolutions, airplane crashes, migrations, and other major events tend to happen with maximum sunspot activity.

Here’s an example (above) of the cycle peak around 2001. You can see that the toppling of the World Trade Center in New York took place at a sunspot spike right at the top of that cycle.

Here’s an example (above) of the cycle peak around 2001. You can see that the toppling of the World Trade Center in New York took place at a sunspot spike right at the top of that cycle.

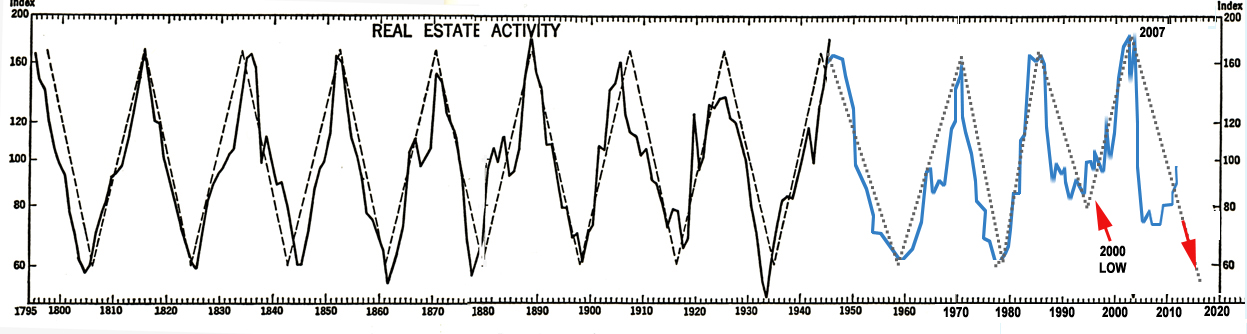

There’s an eighteen and a half year cycle in real estate. This one’s quite well known and influences both activity and prices. We’re experiencing a peak right now around the world, and expecting a crash very soon with a bottom about 2020.

The real estate cycle coincides with the lunar nodal cycle, a period of 18.6 years in which for half of that time the moon is below the equator as it revolves around the Earth and above it for the rest. It’s also a rainfall and drought cycle—9 years of each.

Farmers all over the world certainly know about cycles in both climate and in crop growth. There’s a 3.5 year corn cycle, a 9.6 year wheat cycle, a 17.5 year cotton cycle and it goes on and on.

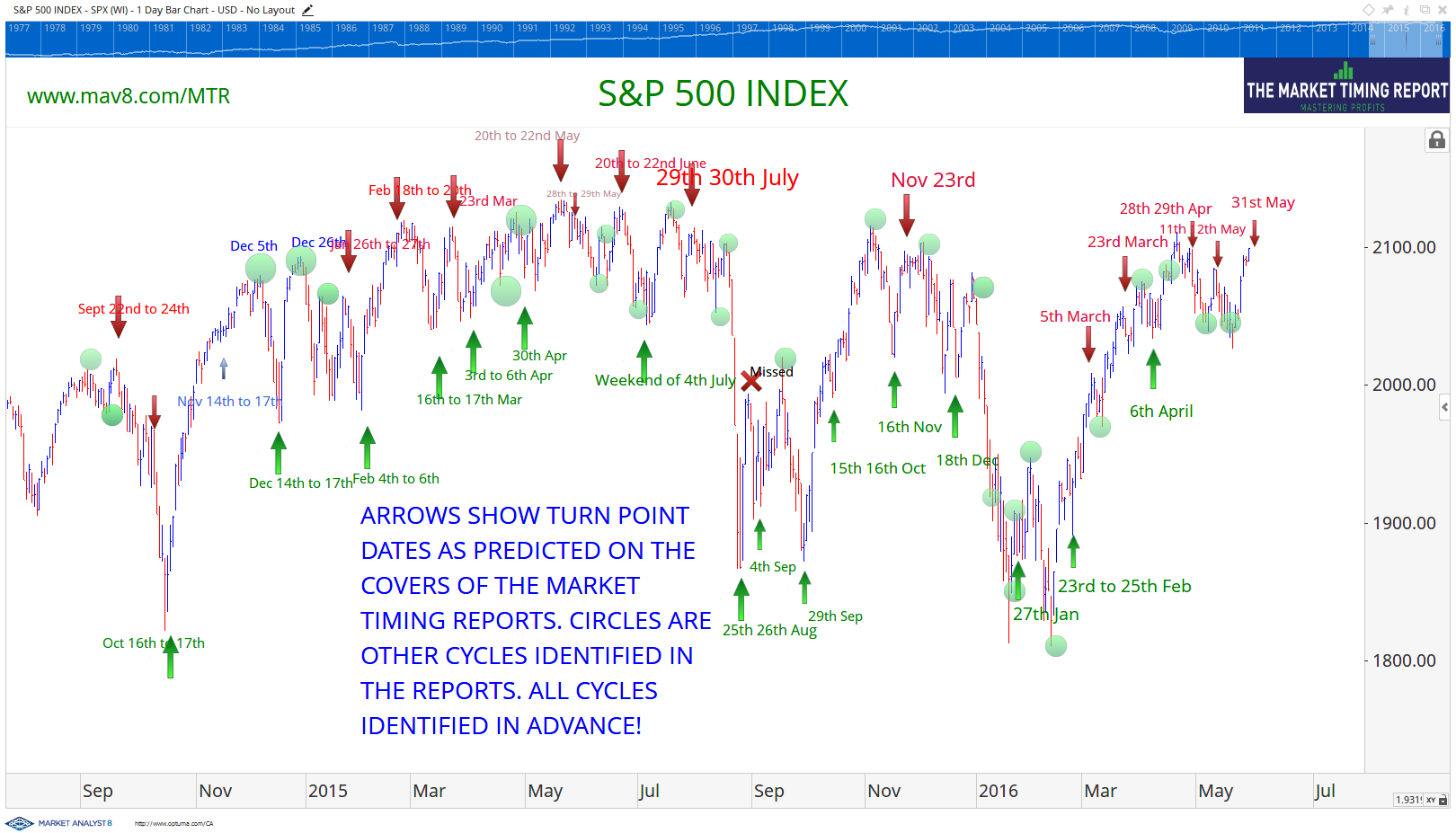

Cycles are a major factor in the movement of the stock market. Successful traders all over the world use cycles as their main means of timing the market. Cycles tell them when to go long or short. Andy Pancholi of London, England has been studying cycles for over thirty years. He publishes a monthly report on cycle turn dates for traders in a wide range of assets, from currencies to commodities to stocks.

He generally focuses on one or two major cycle turns each month. Here’s a chart of the SP500 for the past year and a half, perhaps the most watched US stock index. During this period, his cycle turn predictions have had only one miss. That shows both the accuracy of his projections and validates the fact that stock markets are influenced in a huge way by cycles.

Because human beings control the ups and downs of the market, this strongly suggests that our mood is influenced by forces beyond our control.

Recessions and Depressions also happen in cycles. Here’s a list of the recessions and depressions in the United States throughout the 1800s and into the early 1900s. Notice the length of time between these cycles (the column on the far right). The real estate cycle (18.5 years is a very big factor in depressions).

Panic of 1807

|

+12 years to next |

Downturn of 1819

|

+18 years to next |

Panic of 1837 (began in 1835)

|

+20 years to next |

Downturn of 1857

|

+16 years to next |

Downturn of 1873

|

+20 years to next |

Downturn of 1893

|

+14 years to next |

Panic of 1907

|

+22 years to next |

Great Depression of 1929

|

2016 is the year for the next cycle downturn.

Cycles are in virtually everything. They affect wildlife, agriculture, the business environment, wars, our health and much more.

As Lee Iacocca, the past CEO and chairman of Chrysler once said,

“Life is full of cycles. You’d better understand them, because all of your timing and often your luck is tied up in them.”

Cycles are fascinating. They determine your future. And they’re the reason history repeats. If you know the past, you’ll better be able to predict the future.

Excellent post! Thank you. Regards. Georg

Pete,

I have been wondering about cycles in market patterns.

What do you think, whether the market is rigged unconsciously, or consciously, or it is not rigged ?

Do you think the big market players use cycles consciously or unconsciously ?

Many thanks Pete for your answer.

I know a few market players, like Paul Tudor Jones and Martin Armstrong come from the Foundation for the Study of Cycles, as I did (for a short time). The successful ones know all about cycles and history. The rest of the question is a bit vague.

Thanks Pete for the answer.

May i ask one more question, who is the real and biggest market mover actually in currency ?

Thanks a lot for your insight.

I don’t understand what you mean by market mover—who’s the biggest player in trading the currency market? In that case, I have no idea.

ok thanks for your time Pete, looking forward for more of your works.

thanks

So on the 23-24 cycle, we got a major top in the markets in 2000, at the top of the cycle (as marked) and a major top at the bottom of the cycle. So I don’t think that solar chart helps that much, if at all, IMHO, unless I am missing something.

The Real Estate market goes in a 14-4 sequence. We have had the low, back in 2010-2011. The next is not due until 2028-29.

Hi Dave,

There are lots of cycles, some more powerful than others, but the key seems to be when you get two or more turning in tandem. But let me give you my thoughts on the concerns you raised.

We typically (as you no doubt know) get a market downturn trailing a solar cycle top, within about a year or two after. The most recent cycle top (24) was in 2014 and on May 21, 2015 we had a US market top. I don’t expect a new high, and I expect a crash come September/October.

The real estate cycle is, of course, 18.5/6 years. I peg the low at about the year 2000 in the Northern Hemisphere, which aligns with the lunar nodal cycle (18.6 years) and brings us to a projected low 2018-2020. The Canadian real estate market is at a screaming top at the moment and will certainly come down hard as the market comes down. My video on the the real estate cycle is here.

For the real estate cycle my chart of cycle tops extrapolates from Dewey’s original data, with a recent update based on the lows of 1998/2000. There’s a chart in the blog page with the video I mentioned.

My video on solar cycles is here.

The 2007 top was a 172 cycle turn, which aligns with the 1837 panic (huge depression in the US) and the 1663 depression, blubonic plague and fire of London.

The 2000, 2007, and 2015 market tops are 7 years apart, which is another major cycle. The 2007 top was 86 years after the 1929 turn (172/2 = 86). So cycles are at work at a multitude of levels.

thankssss