Uupdate Friday morning, Oct 30 (before the bell)

Futures acted much as I expected overnight. They completed what looks like a small 5th wave and then retreated and are sitting, waiting. The euro continued up and should get to the previous 4th at 1,1090 before turning down in a second wave. usdcad hardly budged but it set to head down.

We seem to be set up for the possible turn.

___________________________

Update Thursday night after the bell (Oct 29)

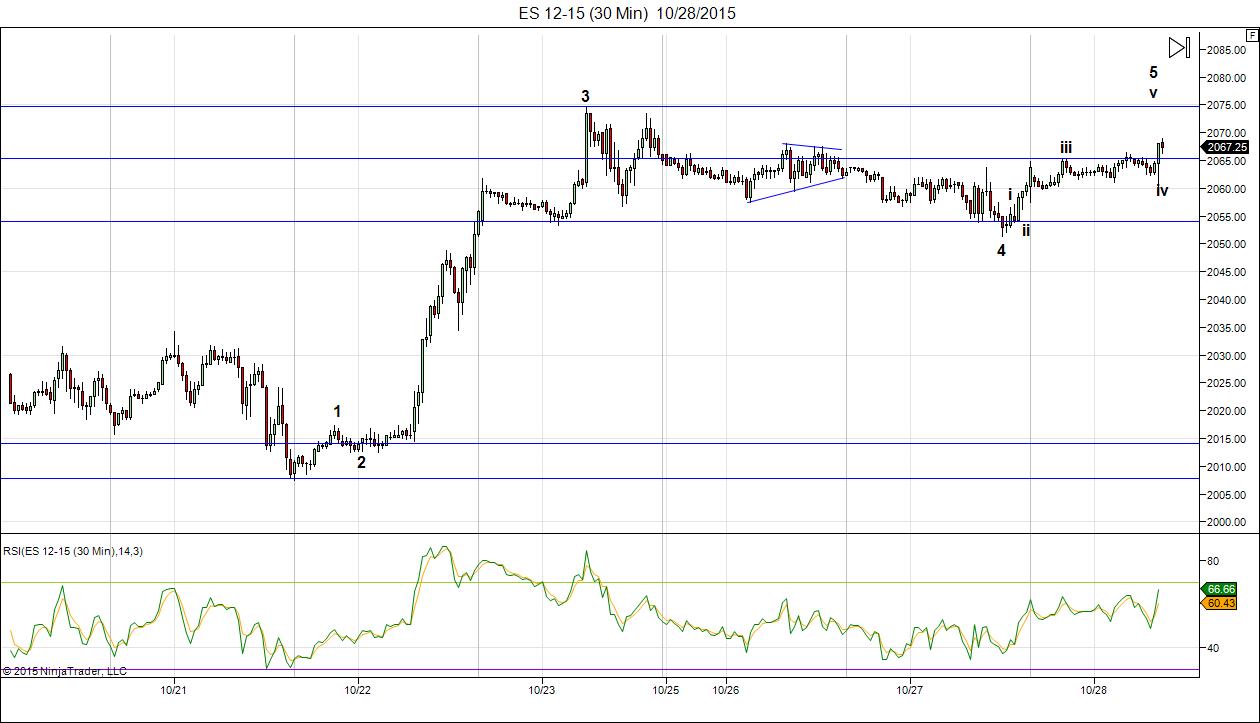

Above is the SP500 (10 minute chart showing the final wave up). I count the wave complete, other than a probably double top. You can see the triangle traced out during the day and the fifth wave up from there. You can see how the waves just keep getting shorter and shorter.

The futures still have to top but will likely do that overnight and the Nasdaq is still lagging. The NYSE has traced out a triangle, which denotes an end wave. We should be set up for a reversal to the downside. The eur/usd appears to have reversed with a set of first waves up (in 5 waves) as has usd/cad.

_____________________

Update Thursday, Oct 29: All eyes on currencies this morning as they’re starting to move. CAD, for example is reversing and will need to retrace the 62% (a second wave) from the highs. Euro should head up and the dollar down.

I have been saying for some time that the euro moves inversely to equities. That’s still appears to be the case. It’s a countertrend move, but the euro has to at least retrace 38% of the wave down (I expect 62%) and it hasn’t done that yet.

In equities, we came down overnight in three waves. I would expect a retrace. Watch for the double top.

NOTE: If we continue up past this top, I would have to seriously consider the stance and my prognosis for a turn down now. So I think we have an inflection point here. I count a fully set of waves up and the NYSE is reaching its target. We have to keep this in mind. I have to keep objective and although I don’t see support for a continued move up, it is what it is.

________________________

Original Post: If you’re a bull, this sums up what I project the near future to hold. Fed Chairman Janet Yellen puts out the monthly FOMC announcement at noon EST today and I expect an outcome similar to that of Sept 17. We will likely rally during the morning and turn down sharply either with the announcement of shortly thereafter. The rest of the week should be bearish.

In Elliott wave lingo, we’re heading down into a third wave, which should be a sharp drop to at least 1.618 X wave 1 down (to Aug. 24). A long consolidation in wave 4 should follow (a couple of months likely) and a final drop into wave 5, which should be of a similar length to wave 3. I’ll be able to get more specific on all these targets once we’ve completed wave 1 of 3.

Let’s look at where we’re sitting in futures this morning:

Above is the ES (SPX futures) showing the rather flat fifth wave. I put us in the final small wave up. There are a couple of ways to label this and the waves are so small, that’s it’s possible we could rise to the original target of 2038, but the market is so weak, I’m not counting on it. My preference is for a double top. The NQ (Nasdaq futures) looks to have already completed an ending diagonal and is poised to complete a double top. So we are literally waiting for the announcement.

Here are a couple of other great candidates for shorts.

___________________

In today’s post, I’ll update all the indices to this morning (Wednesday, Oct 28)

The 10 minute chart of the SP500 (above) shows a breakdown of the C wave with 5 waves up, almost at an end.

I’ve placed a line at what might be the final target for this last wave. We may not make it that far.

At the time of the FOMC meeting, we might have a spike up, but the spike should not last that long. I would expect a turn down before the end of the day and it will likely be sharp.

As we approach the top of this correction, I often get asked where the best place to enter is. Here is a brief explanation of what to expect and the safest point at which to enter a short trade after a first wave down.

___________________________

Here’s the explanation of the correction we’ve formed on almost all the indices: a regular flat.

Currently in the SP500, wave 3 is 1.6 times the length of wave 1. In the final 5th wave, wave iii is 1.6 times wave 1. If wave v traces out the typical full length (1.6 x wave i), it would top at 2052. Based upon what ES did on Friday (an ending diagonal), I find it less likely that wave 5 will extend to its full length.

Currently in the SP500, wave 3 is 1.6 times the length of wave 1. In the final 5th wave, wave iii is 1.6 times wave 1. If wave v traces out the typical full length (1.6 x wave i), it would top at 2052. Based upon what ES did on Friday (an ending diagonal), I find it less likely that wave 5 will extend to its full length.

Any flat correction is in a 3-3-5 pattern. This final wave C has now traced out a complete, or almost complete set of 5 waves. Five waves up marks the end of a sequence and demands a trend change.

In a regular flat correction, “wave B terminates about at the end or about at the level of the beginning of wave A, and wave C terminates a slight bit past the end of wave A.” If we complete a flat that goes to a slight new high, then this would have to be a larger 2nd wave and the downside will be much greater than a 5th wave. For example, the third wave alone would take us down to the low 1600s in the SPX. We would have a 5th wave after that.

The Nasdaq (above) now looks the same as the other indices. We’re very close to the end of the fifth and final wave, which will require a turn down.

The NYSE (above) has not met the 62% retracement level (horizontal line). This is the index that’s lagging all the rest and I would expect it would make the 62% line before turning down. We’re so close that it might simply make the previous high.

The DOW (above) is also just about at the end of the final 5th wave.

The Global DOW (GDOW) has retraced up to to almost the 62% level (horizontal line) but is still short. This is the only other index (besides the NYSE) that has not reached the wave 2 expected target of 62%. This may be good enough, however. It’s just about there. This also creates the second wave scenario in the GDOW with a long 3rd wave down to come.

_________________________

Cycles Analysis

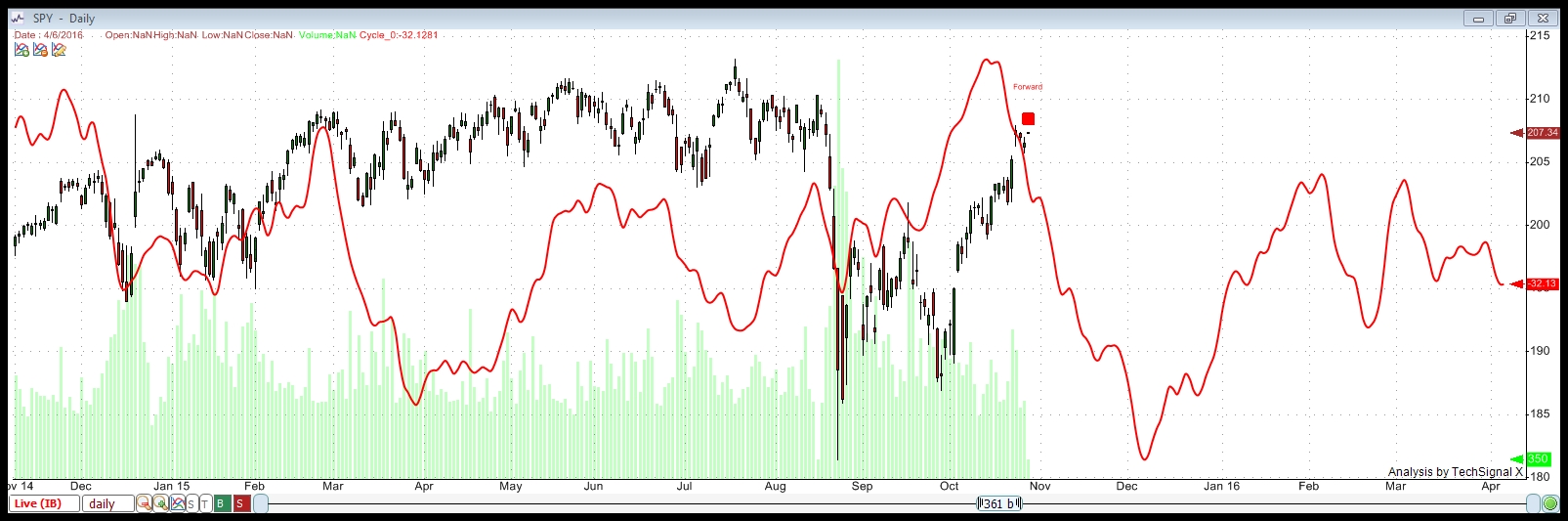

I ran this chart this morning, Wednesday, Oct 28. Not much has changed from the cycles analysis from a week ago. You can click on it to expand.

This cycles analysis uses Techsignal X from the Foundation for the Study of Cycles. I’m using data going back to 2002 this analysis of SPY (SPX) and displaying a compilation of all the cycles the software has found over that period. You can see how close-fitting it has been in the recent past. The fit with the current wave is quite stunning and therefore, something to pay attention to.

This analysis suggests a cycle top of October 13, so we are overdue for a turn down.

It shows a bottom to this set of waves down at December 7, 2015.

This particular cycle top (Oct 13) is a strong one. I’ve gone a little deeper into what the analysis is telling me on a separate page. Here’s a more in-depth explanation of what this chart is suggesting.

_______________________________

The Panic Phase and the TPD (Turning Point Distribution) Principle

The TPD Principle describes a period in time of several weeks in which an array of cycles congregate, including gravitational, geomagnetic, and nuclear. It’s around this time that markets have historically topped. I was asked to include a reference to this in today’s blog post, which I’m happy to do. This principle generally refers to market tops (which we’ve already seen on May 20, 2015), but it’s interesting to note how many astro events we have occurring over the weeks surrounding the upcoming major turn in the market.

In his book, “the Universal Cycle Theory,” Stephen Puetz writes, “The TPD principle involves the eclipse cycle as well. The eclipse cycle normally peaks on the first new moon before a solar eclipse. Following that reversal point, it takes six weeks for sentiment to shift from euphoria to panic. Then on the first full moon after a solar eclipse, a panic-phase begins. A panic phase usually last two weeks—ending at the time of the next new moon.”

The dates:

Aug 14 , 2015 – First New Moon before the Eclipse (there is a New Moon happening at the same time as an Eclipse—Sept. 13)

***Aug 29 – Full Moon before the Solar Eclipse (peak of the eclipse cycle)

Sept 13, 2015 – New Moon and Partial Solar Eclipse

Sept 23, 2015 – Fall Equinox

***Sept 28, 2015 – Super Blood Moon Eclipse (start of panic phase)

***Oct 13, 2015 – New Moon (this would mark the end of the panic phase) – six weeks after the Aug. 29 full moon.

So … we are also due for a turndown based on the Puetz crash cycle.

New post: https://worldcyclesinstitute.com/view-from-the-top-2/